📊 Fxmethods Treasury Desk – Weekly FX - 15TH SEPT'2025 !!

- fxmethods

- Sep 15, 2025

- 2 min read

💱 USD/INR Weekly Snapshot

Open: 88.153 | High: 88.499 | Low: 87.922 | Close: 88.277

🟢 Summary: Pair traded with upward bias, testing near 88.50 before mild profit-taking.

🔮 Projection: Strength likely above 88.30 with scope toward 88.70–88.90. Support sits at 87.90. Watch RBI stance & global USD trends.

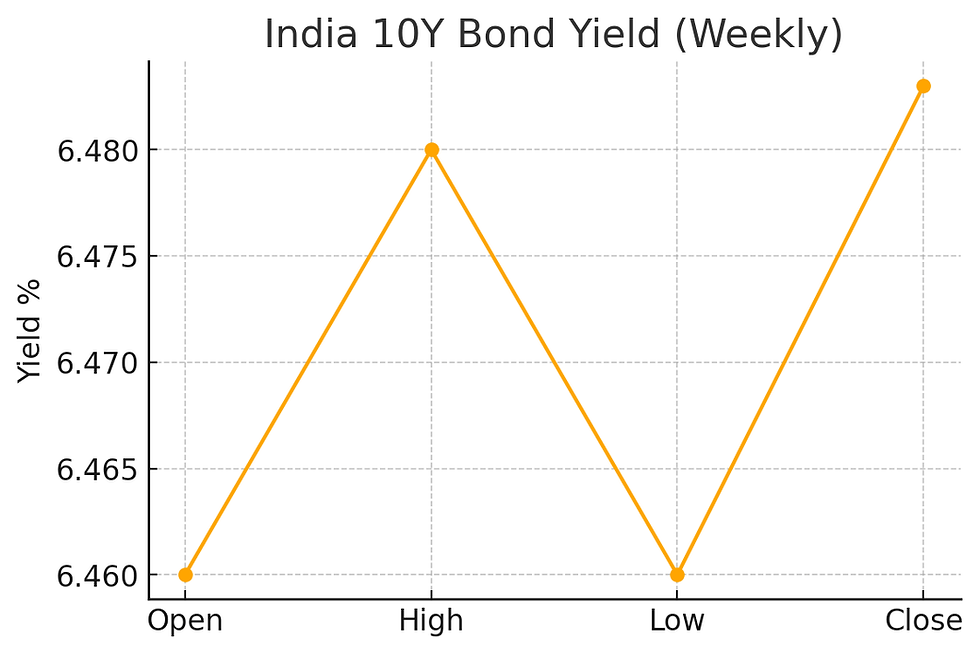

📈 India 10-Year Bond Yield

Open: 6.460 | High: 6.480 | Low: 6.460 | Close: 6.483 (+0.34%)

🟠 Summary: Yields stayed firm on steady global cues and moderate domestic inflation expectations.

🔮 Projection: Consolidation likely in 6.40–6.55 band. Oil uptick may pressure yields higher.

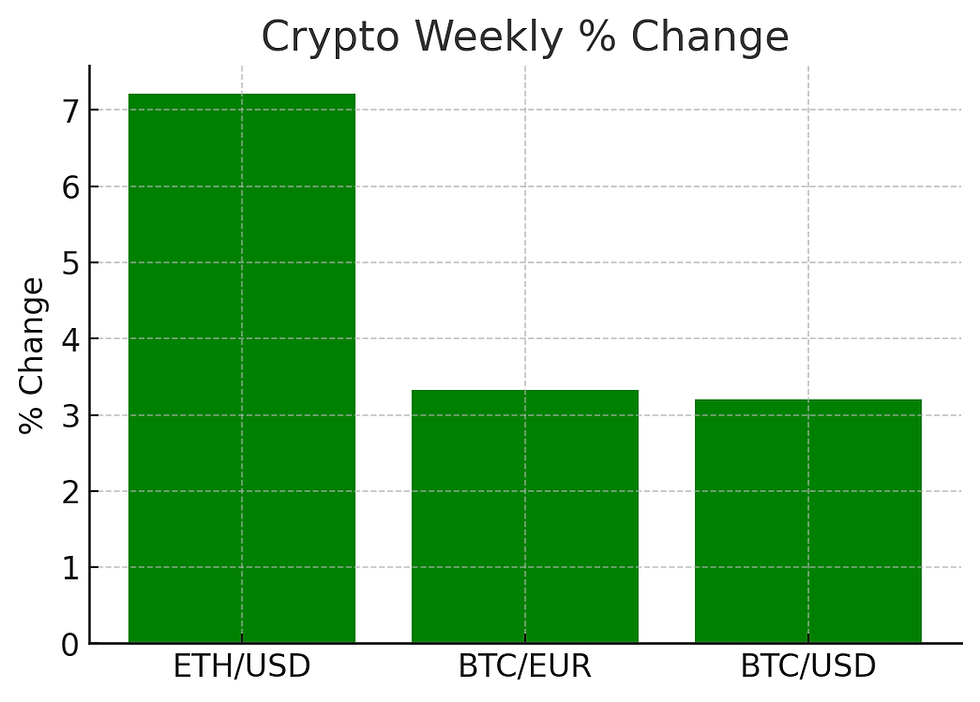

🪙 Crypto Highlights

ETH/USD: 🟢 +7.22%

BTC/EUR: 🟢 +3.33%

BTC/USD: 🟢 +3.20%

🟢 Summary: ETH outperformed BTC on strong network activity & broader risk appetite.

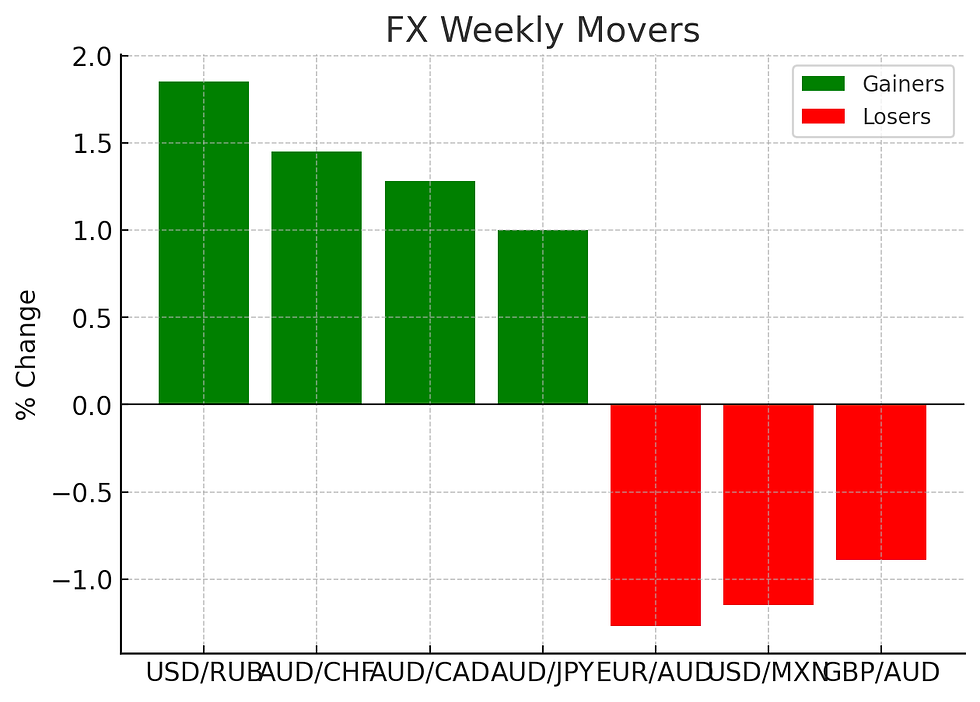

🌍 FX Gainers

USD/RUB: 🟢 +1.85%

AUD/CHF: 🟢 +1.45%

AUD/CAD: 🟢 +1.28%

AUD/JPY: 🟢 +1.00%

🟢 Summary: AUD led gains on commodity strength & risk appetite. RUB weakened on geopolitics.

🔮 Projection: AUD pairs may extend momentum if commodities hold. USD/RUB volatility remains elevated.

📉 FX Losers

EUR/AUD: 🔴 -1.27%

USD/MXN: 🔴 -1.15%

GBP/AUD: 🔴 -0.89%

🔴 Summary: AUD crosses underperformed due to Aussie resilience. Peso gained on strong data.

🔮 Projection: EUR/AUD may drift toward 1.5900 unless eurozone growth surprises.

📌 Upcoming Focus

🏦 US Fed speakers & CPI → Key for USD strength.

🇮🇳 RBI OMO/FX cues → INR direction watch.

🛢 Commodity prices → AUD & EM FX drivers.

💻 Crypto flows & regulations → Market sentiment.

🌐 Fxmethods Treasury Desk – Dynamic Outlook:We expect USD resilience to continue, but select EM & commodity-linked FX may outperform. Bond yields remain rangebound but sensitive to inflation/oil. Crypto sentiment bullish near term with ETH leadership.

GRATITUDE

Comments